Foresiet Combatting Anti-Phishing and Anti-Rogue Services: RBI Mandate for Banks

Learn how Foresiet is helping banks in India combat phishing websites through RBI's mandate for anti-phishing and anti-rogue services.

Understanding RBI's mandate for banks

The Reserve Bank of India (RBI) has issued circular RBI/2019-20/129, which provides guidance for banks in India to subscribe to anti-phishing and anti-rogue application services. This mandate aims to enhance the security of banks and protect customers from phishing attacks.

By subscribing to these services, banks are required to identify and take down phishing websites and rogue applications. This proactive approach helps in safeguarding the interests of the customers and maintaining the integrity of the banking system.

The RBI's mandate is a significant step towards combating cyber threats in the banking sector and ensuring a secure digital environment for customers.

The importance of identifying phishing websites

Phishing websites are designed to deceive users into revealing sensitive information such as login credentials, financial details, or personal data. These websites often mimic legitimate websites to trick unsuspecting users.

Identifying phishing websites is crucial to protect customers from falling victim to such scams. Banks play a vital role in detecting and taking down these websites to prevent financial losses and maintain customer trust.

By implementing effective anti-phishing measures, banks can proactively identify and block phishing websites, minimizing the risk of fraudulent activities and enhancing the security of online transactions.

How Foresiet brand protection services align with RBI's requirements

Foresiet offers comprehensive brand protection services that align with the RBI's requirements for combating phishing websites. By leveraging advanced technologies and industry best practices, Foresiet helps banks in India to effectively identify and take down phishing websites and rogue applications.

Foresiet solution includes real-time monitoring of suspicious websites, automated detection of phishing patterns, and prompt takedown procedures. This proactive approach ensures that banks can swiftly respond to emerging threats and protect their customers from phishing attacks.

With Foresiet brand protection services, banks can enhance their cybersecurity posture and comply with RBI's mandate, thereby safeguarding customer interests and maintaining a trusted banking ecosystem.

Steps banks can take to implement anti-phishing measures

To implement effective anti-phishing measures, banks can follow these steps:

- Conduct regular security assessments to identify vulnerabilities and gaps in the existing infrastructure.

- Educate customers about phishing risks and provide guidance on how to identify and report phishing attempts.

- Implement multi-factor authentication to add an extra layer of security for online transactions.

- Collaborate with cybersecurity experts and service providers to leverage innovative technologies and tools.

- Establish incident response protocols to quickly respond to phishing incidents and mitigate potential damages.

By taking these proactive steps, banks can strengthen their defense against phishing attacks and ensure the security of customer information.

The impact of anti-phishing services on overall cybersecurity

Implementing anti-phishing services has a significant impact on overall cybersecurity in the banking sector. By proactively identifying and taking down phishing websites, banks can prevent unauthorized access to customer accounts, protect sensitive data, and mitigate financial fraud.

These services also contribute to building customer trust and confidence in online banking platforms. When customers feel secure and protected, they are more likely to engage in digital transactions, thereby driving the growth of digital banking.

Furthermore, the collective effort of banks and service providers in combating phishing attacks strengthens the cybersecurity ecosystem as a whole. Sharing threat intelligence, best practices, and collaborating on security initiatives creates a united front against cybercriminals and enhances the overall resilience of the banking sector.

About Foresiet!

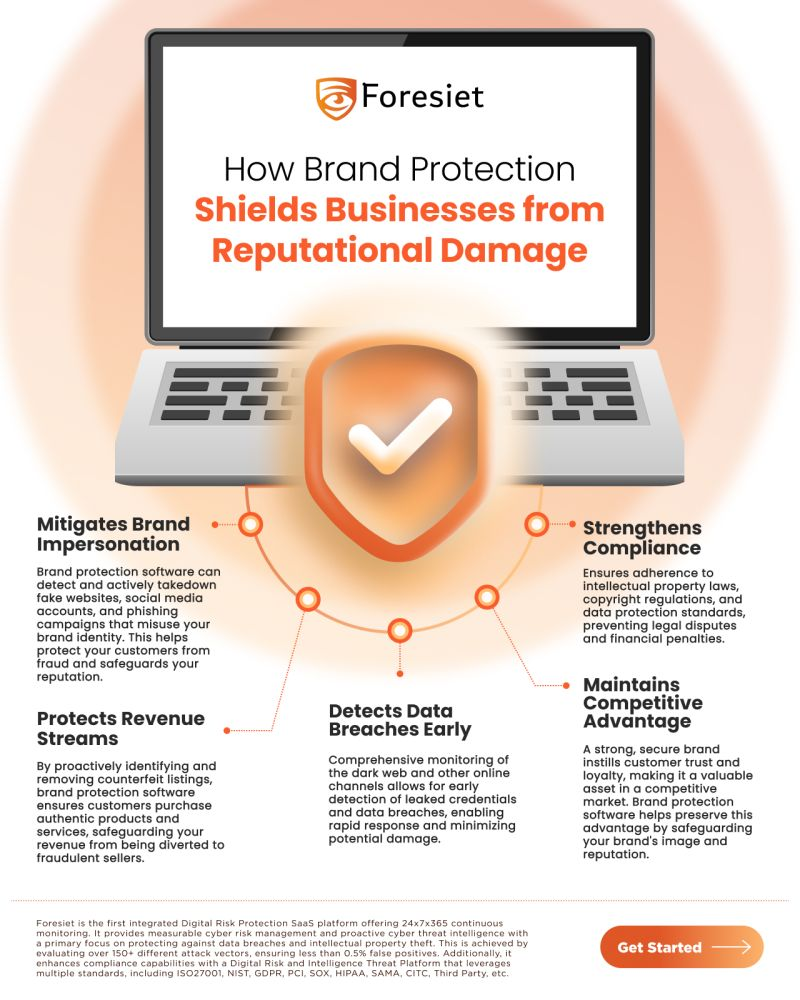

Foresiet is the pioneering force in digital security solutions, offering the first integrated Digital Risk Protection SaaS platform. With 24x7x365 dark web monitoring and proactive threat intelligence, Foresiet safeguards against data breaches and intellectual property theft. Our robust suite includes brand protection, takedown services, and supply chain assessment, enhancing your organization's defense mechanisms. Attack surface management is a key component of our approach, ensuring comprehensive protection across all vulnerable points. Compliance is assured through adherence to ISO27001, NIST, GDPR, PCI, SOX, HIPAA, SAMA, CITC, and Third Party regulations. Additionally, our advanced antiphishing shield provides unparalleled protection against malicious emails. Trust Foresiet to empower your organization to navigate the digital landscape securely and confidently.

Protect your brand, reputation, data, and systems with Foresiet's Integrated Digital Risk Platform. 24/7/365 threat monitoring for total peace of mind.

July 10, 2025, 9 a.m.